스포트라이트

위험 관리자, 내부 감사인, 인증 중위, 인증 관리자, 규정 준수 이사, 규정 준수 운영 관리자

Every organization on Earth has some sort of financial structure, whether it’s a “mom and pop” store, a nonprofit, a company, an insurance firm, or a government agency. And whenever money is involved, you can bet there are rules and regulations about how that money gets used. That’s why most organizations have at least one dedicated Financial Compliance Officer on staff to keep them out of legal trouble.

Financial Compliance Officers carefully review balance sheets, income statements, and other financial documents. They meticulously screen for discrepancies and ensure compliance with applicable federal and state regulations (plus any other guidelines they’re asked to watch out for). Their goal is to find and prevent oversights, errors, and fraud that could impact the integrity of their employer’s finances.

"현재 정책, 절차, 관행 및 작업 흐름을 검토하여 모든 주 및 연방법을 준수하는지 이해하는 것이 제 임무입니다. 개선 할 수있는 영역을 찾을 수 있으면 위험을 줄이도록 설계된 프로그램을 개발하는 데 도움을줍니다. 또한 공급업체 계약을 검토 및 평가하여 회사가 필요한 서비스를 제공할 수 있는지, 전반적인 요구 사항을 지원할 준비가 되어 있는지, 서명을 위한 실제 계약을 구축할 수 있는지 확인합니다. 제 직업의 가장 중요한 측면 중 하나로서 저는 비즈니스 관행에 대한 월별 위험 평가를 수행합니다. 저는 개선할 수 있는 부분을 파악한 다음 이를 관리자에게 전달하고 더 나은 문서화 프로세스 및 품질 관리 검토를 개발하는 데 도움을 줍니다. " 자렛 라이트 카슨, 컴플라이언스 매니저, 알래스카 미국 FCU

- Playing a critical role in preventing financial misconduct and crises

- Opportunities to work in a wide range of organizations

- Collaborating with teams to enhance compliance and risk management

"직원들이 고객과 조직 내의 다른 부서를 도울 수 있는 능력에서 제 직업의 이점을 볼 수 있습니다. 저는 직원들을 멘토링하고, 개발하고, 코칭하여 이 회사를 이끌 차세대 관리 그룹이 되도록 합니다. " 자렛 라이트 카슨, 컴플라이언스 매니저, 알래스카 미국 FCU

근무 일정

- Financial Compliance Officers typically work full-time, with the potential for overtime during audits and examination periods.

일반적인 의무

- Develop and implement risk management strategies and compliance audit plans, procedures, documentation, databases, and tracking systems

- Forge relationships with stakeholders to ensure effective communication and cooperation

- Conduct internal audits, self-assessments, and thorough reviews of financial statements and records to ensure compliance with regulations and identify potential risks and irregularities

- Prepare detailed reports of findings and recommend corrective actions

- Monitor ongoing compliance; follow up on previous findings to make sure they’ve been addressed

- Evaluate the effectiveness of internal controls. Recommend improvements, as needed

- Ensure institutions adhere to federal and state laws and regulations, and submit accurate and timely regulatory filings and reports

- Ensure compliance with anti-money laundering and know-your-customer regulations

- Collaborate with legal and regulatory teams; liaise with external regulatory bodies and auditors

- Train staff on compliance requirements and best practices

Investigate complaints and potential violations of financial regulations - Implement and oversee whistleblower policies and procedures

- Conduct special investigations into potential financial misconduct or regulatory breaches

추가 책임

- Stay current with financial regulations and examination techniques

- Engage in professional development opportunities

- Provide guidance and support to junior officers and other staff

- Assist in the preparation for regulatory examinations and audits

"제 일상은 먼저 회의로 시작됩니다. 저는 부서 내에서 달성해야 할 일의 우선 순위를 정하기 위해 항상 팀 회의를 하려고 노력합니다. 이 회의에서 저는 업무의 우선 순위에 초점을 맞추고 저와 제 팀이 같은 페이지에 있는지 확인한 다음 발생할 수 있는 문제가 있는지 확인합니다. 커뮤니케이션이 핵심입니다. 이 초기 회의 후에는 일반적으로 일일 및 생산 추적기를 검토합니다. 이를 통해 "할 일 목록"에있는 항목, 우선 순위 및 필요한 사람을 볼 수 있습니다. 그런 다음 우선 순위가 가장 높은 항목 또는 가장 빨리 수행 할 수있는 항목을 선택하고 천천히 목록을 공격합니다. 이를 위해서는 때때로 광범위한 읽기, 계약, 법률 문서, 연방법 또는 주법 등이 필요합니다. 점심 식사 후 기어를 바꾸고 팀이하는 일의 훈련 측면에 집중하기 시작합니다. 우리는 훈련 프로그램을 개발하며 이를 통해 많은 방해 없이 이 영역에 집중할 수 있습니다. 하루가 끝날 무렵, 나는 우리 팀이 성취 한 것과 내가 한 일에 대한 비공식적 인 검토를 수행 한 다음 다음 날과 아침 회의를위한 계획을 세웁니다. " 자렛 라이트 카슨, 규정 준수 관리자, 알래스카 미국 FCU

소프트 스킬

- 능동적 인 듣기

- 적응성

- 분석

- 규정 준수 지향

- 비판적 사고

- 디테일 지향

- 징계

- 재정적 통찰력

- 무결성

- 끈기

- 고집

- 설득

- 계획 및 조직

- 문제 해결 능력

- Skepticism

- 건전한 판단

- 강력한 의사 소통 기술

- 팀워크

- 시간 관리

기술 능력

- Data analysis and interpretation, using tools like Microsoft Excel, Tableau, or SPSS to identify trends and anomalies

- Familiarity with regulatory compliance software such as SAS, MetricStream, or IBM OpenPages for monitoring and ensuring compliance

- Knowledge of financial regulations and standards, utilizing tools like Wolters Kluwer Compliance Solutions

- Proficiency in financial analysis and auditing techniques and programs, utilizing software like QuickBooks, SAP, or ACL Analytics for thorough financial reviews

- Report writing, using Microsoft Word or Google Docs

- Risk management, employing tools like Archer or RiskWatch to develop and implement effective risk mitigation strategies

- Understanding of banking and financial systems, using platforms like Fiserv, Jack Henry, or Oracle Financial Services to manage and oversee banking operations

- Banks and credit unions

- Companies and corporations

- Financial consulting firms

- 정부 기관

- 보험 회사

- Investment firms

- 비영리 단체

Financial Compliance Officers are expected to maintain high standards of accuracy and integrity. Their role is crucial in identifying and mitigating risks within their employing institutions. There’s a ton of pressure to ensure compliance and avoid fines or sanctions, so they must be vigilant and detail-oriented because even minor oversights can lead to significant repercussions.

The job requires extensive research and continuous education to keep up with changing laws and regulations. Hours can be long and the role can be stressful at times, but there’s job satisfaction from protecting organizations and consumers from financial misconduct. Also, the skills and experience gained in this role can open doors to advanced positions within the field!

The financial industry is increasingly utilizing technology to improve compliance processes. Automation, artificial intelligence, and blockchain are becoming integral in detecting irregularities and ensuring transparency. Regulatory Technology solutions are on the rise, helping compliance officers manage regulatory requirements by streamlining reporting, enhancing risk management, and reducing the time and cost of compliance activities.

There’s also a growing emphasis on sustainable finance and environmental, social, and governance regulations. Financial compliance officers are thus charged with ensuring their institutions adhere to these strict standards and exhibit more responsible corporate behavior!

- 보드 게임을하고 규칙을 탐구합니다.

- 책을 읽고 문제를 해결합니다.

- 개인 소지품을 정리합니다.

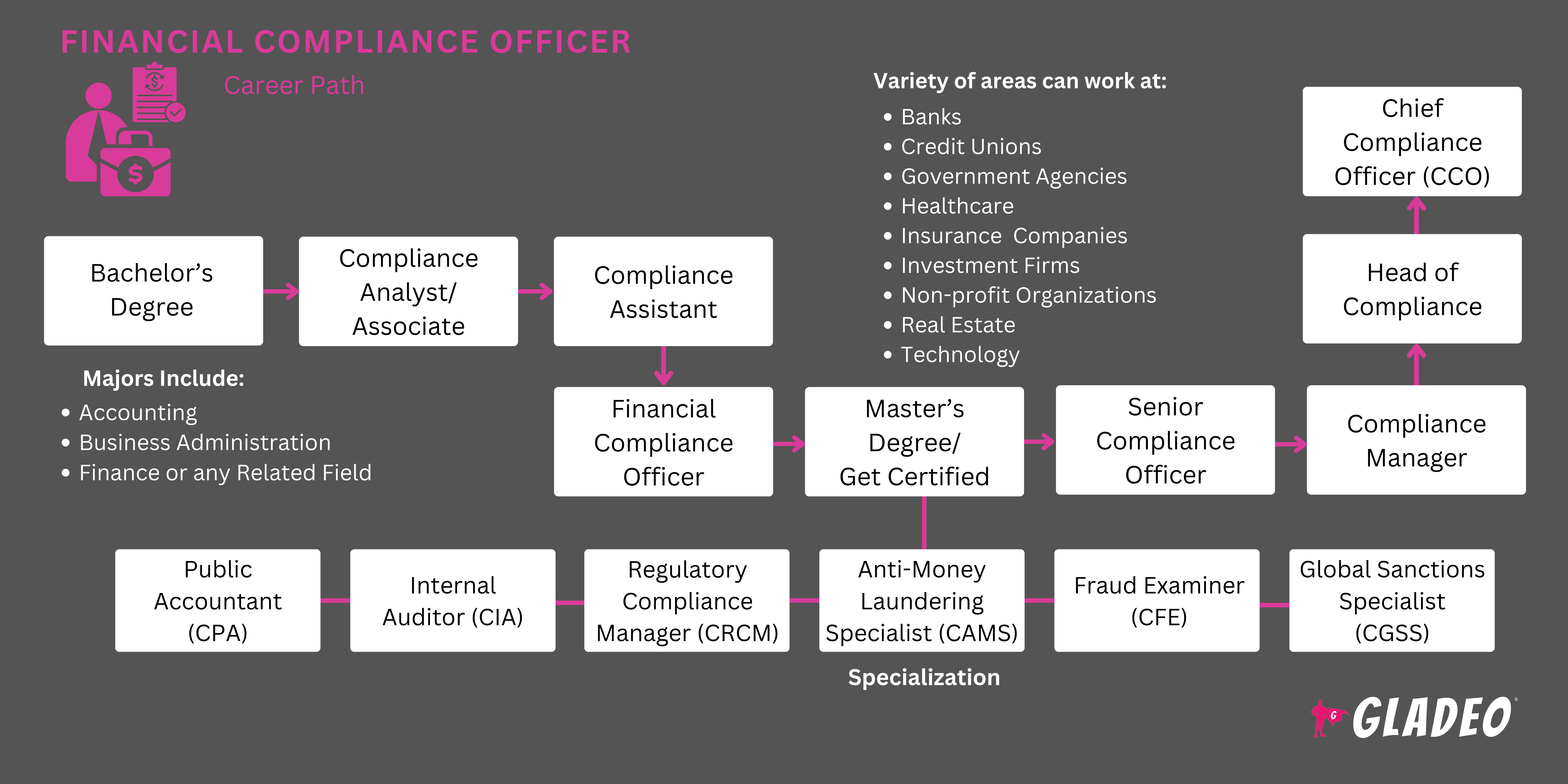

- A bachelor’s degree in finance, accounting, business administration, or a related field is typically required to get started. However, relevant work experience is also essential. Some companies offer on-the-job training, internships, or other mentorship programs, but most Financial Compliance Officers still have to work their way up to the role

- Workers require in-depth knowledge of finance, auditing, compliance, financial regulations, and standards. They should also be proficient with compliance and financial analysis software and must understand risk management principles and practices

- Continuous professional development (via classes, certifications, conferences, workshops, and seminars) is needed to stay updated on regulatory changes and industry best practices

- Advanced positions may require a master’s degree and/or additional certifications such as:

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Regulatory Compliance Manager (CRCM)

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Fraud Examiner (CFE)

- Certified Global Sanctions Specialist (CGSS)

- Look for reputable, accredited college programs in finance, accounting, or business administration, with programs emphasizing financial regulations, auditing, and compliance.

- Decide early if you plan to pursue a master’s. It may be easier to complete a bachelor’s and master’s at the same school, perhaps via a dual program.

- In addition, consider the following:

- Costs of tuition (including in-state versus out-of-state tuition rates).

- Discounts or scholarship options.

- Whether federal aid will help cover costs or not.

- Whether to enroll in an on-campus, online, or hybrid program.

- The experience and achievements of the faculty.

- Opportunities for internships or cooperative learning.

- Graduate job placement stats and details about the program’s alumni network.

- Study hard in math, finance, economics, statistics, business, physics, and computer science/programming classes

- Volunteer for student activities where you can manage money and learn practical soft skills

- Consider applying for part-time jobs in accounting or finance

- Review job postings in advance to see what the average requirements are. If you know which company or employer you want to work for, ask to schedule an informational interview with one of their working compliance officers to learn more about their jobs

- Seek out internships and cooperative experiences in college

- Keep track of the names and contact info of people who might serve as future job references

- Study books, articles, and video tutorials related to financial laws. Participate in online discussion groups

- 전문 조직과 협력하여 배우고, 공유하고, 친구를 사귀고, 네트워크를 성장시키십시오(리소스 > 웹사이트 목록 참조).

- Knock out any relevant certifications as soon as you can to bolster your credentials and make you more competitive in the job market

- Get some practical work experience under your belt before applying, if possible. Jobs related to finance, accounting, and business will look good on an application

- A master’s isn’t needed to get started working in this field, but a graduate degree may put you ahead of the competition

- Let your network know you are looking for work. Most job opportunities are still discovered through personal connections

- Check out job portals such as Indeed, Simply Hired, and Glassdoor, as well as the career pages of companies you are interested in working for

- Check out a few online Financial Compliance Officer resume templates for formatting and phrasing ideas

- Screen job ads carefully and only apply if you’re fully qualified. Include keywords in your resume, such as:

- AML/KYC Compliance

- Artificial Intelligence in Compliance

- Audit Procedures

- Blockchain Technology

- Compliance Databases

- Data Analysis (Excel, Tableau, SPSS)

- Financial Analysis

- Financial Reporting

- Financial Systems (QuickBooks, SAP, Fiserv)

- Internal Controls

- RegTech Solutions

- Regulatory Compliance Software (SAS, MetricStream, IBM OpenPages)

- Risk Management (RSA Archer, RiskWatch)

- Finance-related apprenticeships or cooperative experiences can help get your foot in the door. They look great on resumes plus may yield some personal references for later

- Move to where the most job opportunities are! Some states with the highest employment level for finance jobs are New York, California, Texas, Illinois, and Florida

- 많은 대기업이 지역 프로그램 졸업생을 채용하므로 대학 프로그램이나 커리어 센터에 문의하여 채용 담당자 및 취업 박람회와의 연결에 도움을 요청하세요.

- Career centers also offer assistance with resume writing and mock interviewing!

- Ask former teachers and supervisors if they’ll serve as personal references. Don’t give out their contact info without permission

- Make an account on Quora to ask job advice questions from workers in the field

- Financial Compliance Officer interview questions to prepare your responses. Sample questions might include: “What are the key regulatory frameworks that a Financial Compliance Officer should be familiar with?” or “How do you handle conflicts between compliance requirements and business objectives?”

- Dress appropriately for job interview success!

"직무의 책임을 나열하지 않는 효과적인 이력서를 작성하십시오. 당신이 한 일과 얼마나 잘했는지에 대해 이야기하십시오. 행동, 영향 및 결과에 중점을 둡니다. 당신은 무엇을 했고, 회사를 위해 무엇을 했으며, 당신의 행동의 최종 결과는 무엇이었습니까? 이력서는 독자에게 당신이 그 직업에 적합한 사람임을 확신시키는 데 필요한 만큼 길어야 합니다." 자렛 라이트 카슨, 규정 준수 관리자, 알래스카 미국 FCU

- Be resilient and maintain your professionalism at all times. Build your reputation as an ethical Financial Compliance Officer who offers feasible ideas and solutions to problems

- Constantly listen to and learn from other seasoned professionals so you can avoid issues they may have encountered

- Demonstrate a willingness to assume more responsibility and tackle increasingly complex tasks

- Knock out additional education and training to improve your technical skills

- Keep growing your professional network. Attend events, conferences, and workshops

- Seek feedback from supervisors and colleagues to identify areas for improvement

- Consider relocating or switching employers if necessary to achieve career goals

- Stay informed about industry trends and changes by reading industry publications and joining professional associations

- Develop your analytical skills to analyze complex data and identify potential compliance risks. Learn about new programs and technologies

- Cultivate strong communication skills to explain complex regulations clearly to different stakeholders

- Demonstrate leadership by leading compliance projects, mentoring junior staff, and contributing to your team’s success

- Be detail-oriented in reviewing documents, monitoring compliance activities, and ensuring all regulatory requirements are met

- Build strong relationships with regulatory bodies to better understand their expectations and facilitate smoother compliance audits and inspections

- Foster a culture of compliance within your organization by training staff, promoting ethical behavior, and ensuring everyone understands the importance of compliance.

"희생과 헌신. 당신이 더 나아지는 데 도움이 될 것이라고 알고있는 것들을 위해 필요하지 않거나하지 말아야 할 것들을 희생하십시오. 당신의 계획에 전념하십시오. 당신의 계획은 전반적인 목표를 달성하는 데 도움이 될 것입니다." 자렛 라이트 카슨, 규정 준수 관리자, 알래스카 미국 FCU

웹사이트

- 미국 은행가 협회

- American Compliance Association

- Association of Certified Anti-Money Laundering Specialists

- Association of Certified Chief Financial Officers

- Bankers Online

- Compliance & Ethics Blog

- Compliance Today

- Compliance Week

- Corporate Compliance Insights

- 금융 산업 규제 당국

- Global Association of Risk Professionals

- Institute for Financial Markets

- 내부감사원

- International Compliance Association

- Journal of Financial Compliance

- National Association of State Boards of Accountancy

- National Society of Compliance Professionals

- Regulatory Compliance Watch

- Risk & Compliance Journal

- Risk Management Association

- Securities and Exchange Commission

- Thomson Reuters Compliance Learning

책

- Financial Regulation: Law and Policy by Michael S. Barr

- Principles of Financial Regulation, by John Armour, et. al.

- The Essentials of Risk Management by Michel Crouhy, et. al.

Financial Compliance Officers bear professional responsibility for keeping their organizations compliant with numerous regulations. Sometimes, mistakes still happen and companies get fined or even prosecuted. In rare cases, the compliance officers themselves may face personal liability if they also made mistakes. As a result, it is important to weigh the career’s rewards with its potential risks!

For those who want to explore alternative career paths that rely on similar skills, check out our list below.

- 세관 중개인

- 문서 관리 전문가

- Environmental Compliance Inspector

- 기회 균등 담당자

- 재무 분석가

- Forensic Accountant

- Government Property Inspector

- Internal Auditor

- Quality Control Systems Manager

- Regulatory Affairs Manager

- 리스크 관리자

은행 규정 준수는 더 큰 재무 심사관 그룹의 일부입니다. 비즈니스가 법적 문제뿐만 아니라 도덕적 문제를 탐색하도록 돕는 것입니다. 사기 또는 기타 재정적 문제를 예방하려는 개인이라면 훌륭한 경력 경로입니다. 이러한 개인은 최선을 다해 조직을 진정으로 돕는 동시에 고객을 도울 수 있습니다.

법률 문제에 능숙해야 하고 금융 세계에 대한 지식이 있어야 합니다.

뉴스 피드

주요 채용 정보

온라인 과정 및 도구